Dear shareholder,

FY13 continued to be a challenging year for many retailers. At Halfords we responded to these challenges by announcing in April 2012 a revised strategy to deliver a sustainable business.

This, therefore, has been a year of embedding the processes, procedures and incentives across the business to deliver this new strategy.

During the year David Wild resigned, and following this resignation the Board recruited Matt Davies as the new CEO. He was appointed to the Board in October 2012.

In light of these changes, the Committee has looked to ensure that our Remuneration Policy is appropriate not only to attract and retain a high-calibre CEO, but to incentivise all colleagues to deliver a sustainable business based on the Company's strategy, leading ultimately to an increase in shareholder value.

The Committee has faced three major challenges during the year.

1. Recruitment arrangements for the new CEO

In attracting a new CEO the Committee looked not only at the annual package required to attract a high-calibre individual, but also at how to incentivise that individual against the need to develop a sustainable business and shareholder value, aligning his remuneration with these goals. More details about these arrangements can be found in the Key Elements of Remuneration Policy and CEO Co-Investment Award. The Committee therefore decided it was appropriate, as part of his recruitment package, to make him a CEO Co-investment award.

On recruitment the new CEO invested £500,000 in Halfords shares. He was then awarded a maximum matching share award of 3.5 times his investment. These matching shares may vest over a period between three and five years from award based on achieving stretching share price performance targets. The Committee believes this plan was necessary to recruit this high-calibre individual and will incentivise him to generate significant value for shareholders.

2. Annual Bonus performance measures

As set out in the Remuneration Report last year, the Committee decided to include in 2012/13 bonuses an element based on the achievement of key strategic goals which the Committee ultimately believes will lead to the creation of shareholder value. The bonus is therefore based 75% on PBT and 25% on strategic goals. For 2013/14, the Committee determined that the strategic objectives would be linked to the delivery of the Company's strategy of delivering sustainable and profitable revenue growth through Helping and Inspiring our Customers with their Life on the Move and the delivery of the Getting Into Gear 2016 programme.

3. Review of the performance measures for the Performance Share Plan ("PSP")

Our strategic focus for the medium-term is on putting in place the foundations to deliver a sustainable business, focusing on an authoritative range of products, colleague and service excellence, digital participation and helpful store environments with the ultimate goal of delivering profitable top line revenue growth and therefore creating shareholder value. As a consequence, during the year the Committee reviewed the performance measures used for the PSP. The Committee determined that Total Shareholder Return and Earnings per Share were no longer the most suitable mechanisms for measuring and incentivising the successful delivery of this strategy.

The Committee is currently consulting with shareholders regarding the most suitable performance conditions for use in aligning the Executives with the delivery of the Company's strategy, these proposed changes and final details will be provided in a Stock Exchange announcement, once finalised, and next year's Directors' Remuneration Report.

Remuneration received in respect of 2012/13

A salary review conducted during the year resulted in an increase of 1.8% in October 2012 for all colleagues except the Executive Directors.

The CEO earned a bonus of 37.5% of salary and the Executive Directors earned bonuses of 20% of salary. The Committee determined that this level of bonus was appropriate, reflecting strong performance against key strategic objectives during the year. PSP awards granted in 2010 will lapse in 2013 because the EPS and TSR targets were not met.

Remuneration reporting

In light of industry consultations in 2012 and the publication of draft BIS regulations, which will apply for Halfords for the 2013/14 year-end, the Committee has sought to introduce new disclosures into the Directors' Remuneration Report. We hope shareholders find these changes useful.

Priorities for 2013/14

The priorities for the Committee in the forthcoming year continue to be to ensure that the Company's policy is aligned with the strategy and long-term sustainable success of the business.

In summary the Committee has dealt with a number of changes over the last year both specific to the Company and in response to Government consultations and is committed to ensuring that the Company's remuneration arrangements are designed to drive sustained shareholder value and that the proper levels of transparency are maintained.

Yours faithfully

Keith Harris

Chairman of the Remuneration Committee

23 May 2013

Executive Remuneration Policy

The Remuneration Committee seeks to support the delivery of the Group's corporate strategy through establishing appropriate remuneration arrangements. Our goal is to build a strong long-term business by delivering ongoing sales growth and sustainable shareholder returns through the delivery of authoritative ranges of products, colleague and service excellence, digital participation and helpful store environments.

Consequently, the overall remuneration policy of the Committee, and of the Board, is to provide remuneration packages for Executive Directors and other senior managers in the Group which:

- Attract and retain – Enable the Group to attract and retain management of the right calibre with the necessary financial, retail, customer service, and digital skill sets required to deliver a sustainable business model and drive shareholder returns. Remuneration arrangements are set at levels which are appropriate to achieve this goal without paying more than is necessary. Benchmarking exercises are undertaken at appropriate intervals to inform the position of executives' pay relative to the market, and without seeking to "match the median" to identify and mitigate the risk of losing strong performers.

- Variable pay linked to the delivery of the strategy – Provide management with the opportunity to earn competitive remuneration through annual and long-term variable-based pay arrangements that are designed to support delivery against key strategic objectives. Performance measures are aligned with strategic goals so that remuneration arrangements are transparent to Executives, shareholders and other stakeholders. Different elements of executive pay are delivered over the short and longer terms and are designed to ensure that a substantial proportion of the Executives' remuneration is variable and performance-related.

- Executives as shareholders – Align management's interests with those of shareholders by incentivising management to deliver the Group's long-term strategy of a sustainable, growing business and thus enhance shareholder value. A significant portion of reward is delivered in shares to create alignment of interests.

- Sustainable performance – Remuneration arrangements are designed to support the sustainable delivery of performance and to prevent excessive risk taking.

The overall balance is illustrated here.

Fixed Pay

(26% – 100% of pay

depending on performance) | Performance Related Pay (0% – 74% of pay depending on performance) |

|---|

| Annual | Long-term |

|---|

| Base Pay | Annual Bonus – Based on delivery of financial and strategic objectives | Performance Share Plan – Awards vesting at the end of a 3-year performance period dependent on the delivery of performance conditions aligned to business strategy. |

| Benefits | | Co-Investment Share Award – One-off award to CEO only. CEO was required to invest £500,000 into shares with the opportunity to earn matching shares based on meeting share price performance targets over years 3, 4 and 5 of a 5-year performance period. |

| Pension | | |

Key Elements of Remuneration Policy

| Purpose and link

to strategy | Operation | Maximum

Opportunity | Performance Measures | Changes in

the Year |

|---|

| Base Salary | Base salary is set at an appropriate level to attract and retain management of the right calibre with the necessary financial, retail, customer service, and digital skill sets required to deliver a sustainable business model and drive shareholder returns. | Policy is to position salaries at around median levels, subject to experience and performance and without seeking to "match the median". Executive Directors and executive managers' remuneration is benchmarked at appropriate intervals compared to other companies of a similar size and complexity and compared to other UK listed retailers. | n/a | n/a | None |

| Annual Bonus | To incentivise executives to achieve annual earnings targets and performance against strategic goals. The CEO is further incentivised to manage risk and align his long-term interests with those of shareholders through deferral into shares. | Targets set annually to ensure they are appropriately stretching for the delivery of threshold, target and maximum performance.

For the CEO, two-thirds of the bonus is paid in cash with one-third deferred in shares for three years.

For the Finance Director, the bonus is paid in cash.

Bonuses are non-pensionable. | CEO: Maximum award 150% of base salary. | On appointment, the Committee agreed that the CEO should participate in an annual bonus for his period from appointment on 4 October 2012 to the end of the financial year, 29 March 2013. His maximum bonus opportunity for this period was set at 50% of this normal maximum (i.e. 75% of his full year base salary), with two-thirds paid in cash and one-third deferred into shares for a period of three years. 50% of the bonus was based on PBT performance and 50% was based on the delivery of key personal performance objectives. | All Executive Directors will be measured against PBT and the

Strategic project goals which are determined each year by the Committee to ensure continued focus on the Company's ongoing strategy. The Committee has selected new project goals for 2013/14 which are aligned with our strategy of building a sustainable business. |

| Finance Director: Maximum award 100% of base salary. | 75% of the bonus is based on the achievement of PBT targets.

25% of the bonus is based on the achievement of strategic project goals.

PBT targets range from 92% of budget, where payment is zero to 106% of budget for maximum payment.

In determining whether any bonus are payable the Committee retains the discretionary authority to increase or decrease the bonus to ensure that the level of bonus paid is appropriate in the context of performance. |

| Benefits | Attract and retain management of the calibre required to execute the Company's strategy. | Base salary for executives is supplemented with a car plus fuel or cash allowance, private health insurance and life assurance. | n/a | n/a | None |

| Pensions | Enable the Company to offer market competitive remuneration through the provision of additional retirement benefits. | Defined contribution funding to the Halfords Pension Plan or payments into a personal fund. | CEO: 20% of base salary.

FD: 15% of base salary. | n/a | None |

Performance

Share Plans | To attract and retain executives of the right calibre, whilst aligning their interests with those of our shareholders by incentivising them to deliver against the three-year Company Strategy that seeks to create a sustainable business and maximise returns to shareholders. | Annual awards of shares and vesting over a three-year performance period | Maximum core award 150% of base salary.

Performance multiplier of 1.5x core award for exceptional

performance. | The Committee is currently consulting with shareholders regarding proposed new measures and will provide final details a Stock Exchange announcement when finalised and in the DRR next year. | During the year the Committee considered the performance measures used for the PSP and is proposing to change the measures to create better alignment with our three-year strategic priorities. |

CEO

Co-Investment

Award | To recruit and retain a high-calibre CEO, whilst aligning his interests with those of our shareholders and rewarding growth in share price. | The CEO was required to invest £500,000 in Halfords shares to participate in this plan.

The CEO can receive an award of matching shares that vest over a period of between three and five years. | The maximum number of matching shares is 3.5x the number of investment shares acquired. | Share price performance targets set in years 3, 4 and 5. | Introduced during the year as a one-off incentive on the appointment of the new CEO. |

Director

Shareholding

Guidelines | To align Directors' interests with those of our shareholders and to incentivise the delivery of the corporate strategy, thus creating value for all shareholders. | Executive Directors are required to acquire and retain shares with a value equal to 100% of their annual base salary. Executive Directors have a five-year period to build this shareholding following their appointment. | n/a | n/a | None |

| | | | | |

Remuneration Policy for New Hires

When hiring a new Executive Director, the Committee will seek to align the remuneration package with the above policy. However, to ensure that the right calibre of individual is appointed to the Board the Committee retains discretion to make remuneration proposals that are outside this standard policy where it considers it is necessary to do so. In determining the appropriate arrangements the Committee may look to benchmark the role and remuneration against its peer group and may also take into account other relevant factors such as the remuneration levels of other Executive Directors and the type of remuneration being offered.

The Committee may also make arrangements to compensate the new Executive for 'loss' of existing remuneration benefits when leaving a previous employer. In doing so the Committee may take account of the form in which they were granted, the relevant performance conditions and the length of the time that the performance periods have to run.

Remuneration Arrangements in Different Performance Scenarios

As outlined above, the remuneration policy is designed to ensure that a substantial proportion of the Executive Directors' remuneration is variable and performance-related. By linking the remuneration of the individual Executive Director to the performance of the Company, the Board seeks, as far as possible, to motivate that individual towards superior business performance and shareholder value creation, and to only pay rewards when these goals have been realised. Performance measures are aligned with strategic goals so that remuneration arrangements are transparent to Directors, shareholders and other stakeholders.

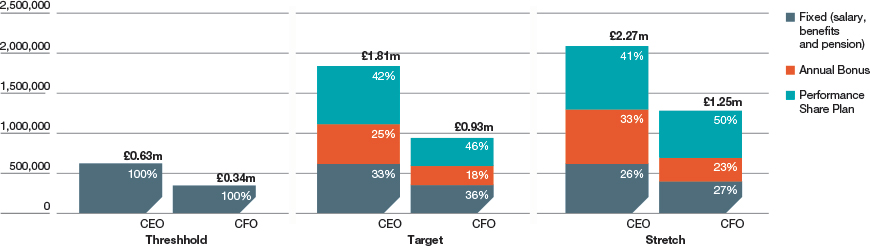

The charts below illustrate remuneration arrangements in different performance scenarios. The assumptions for each scenario are outlined below:

| Threshold performance | - Fixed pay (base salary, benefits and pension) only

|

| On-target performance | - Fixed pay

- 90% of salary annual bonus payout for CEO, 60% of salary annual bonus payout for Finance Director

- 100% of salary payout under the Performance Share Plan

- CEO only – Award annualised by one-third to take account of one-off nature of award, 30% of matching share award vests

|

| Stretch target performance | - Fixed pay

- 150% of salary annual bonus payout for CEO, 100% of salary annual bonus payout for Finance Director

- 225% of salary payout under the Performance Share Plan

- CEO only – Award annualised by one-third to take account of one-off nature of award, 100% of matching share award vests

|

| Executive director | Base salary | Benefits | Pension | Total fixed

remuneration |

|---|

| Matt Davies (CEO) | £500,000 | £28,636 | £100,000 | £628,636 |

| Andrew Findlay (CFO) | £280,500 | £16,335 | £41,250 | £338,085 |

Share Arrangements in Place

The Company had adopted three share plans: The Halfords Sharesave Scheme; the Halfords Company Share Option Scheme ("CSOS"), a market value share option plan; and the Halfords Performance Share Plan ("PSP").

In 2012 the Company also made the new CEO a one-off Co-Investment Share Award. This was made under Listing Rule 9.4.2, where the long-term incentive scheme arrangements are for an "individual whose appointment as a director is being contemplated and the arrangement is established specifically to facilitate, in unusual circumstances the recruitment and retention of the relevant individual". It is currently not intended that further Co-Investment Share Awards will be made.

While committed to the use of equity-based performance-related remuneration as a means of aligning Directors' interests with those of shareholders, the Committee is aware of shareholders' concerns on dilution through the issue of new shares to satisfy such awards. Therefore, when reviewing remuneration arrangements, the Committee takes into account the effects such arrangements may have on dilution. Halfords intends to comply with the ABI guidelines relating to the issue of new shares for equity incentive plans. The current 10 year shareholder dilution is 3.34%.

| Plan | Date of

Adoption | Eligibility | More Information |

|---|

Halfords Sharesave Scheme

("SAYE") | May 2004 | An all-employee SAYE scheme in which all Executive Directors are eligible to participate. | The Committee considered the principles behind the establishment of the SAYE scheme in 2011 and concluded that the current scheme remains appropriate. Options are granted at an exercise price not less than 80% of market value at the date of grant. Options may not normally be exercised until the option holder has completed his or her savings contract (normally three or five years) from the date of commencement of the savings contract. Executive Directors may also join the Halfords Sharesave Scheme. During the year awards were granted under the SAYE to participating eligible employees in the United Kingdom, Ireland and Hong Kong. |

Halfords Company

Share Option Scheme

("CSOS") | May 2004 | Used to reward employees below the Board and it is not the current intention to grant awards under the CSOS to Executive Directors (other than in exceptional circumstances). | The CSOS is a market value option plan which incentivises senior management to grow the share price. Options are granted at an exercise price not less than market value at the date of grant and are normally subject to performance. Currently, vesting of options is subject to an earnings per share hurdle. |

Halfords Performance Share Plan

("PSP") | July 2005 | The PSP is intended to be the main incentive vehicle for Executive Directors and senior executives immediately below the Board, with awards generally made on an annual basis. | Awards granted under the plan are subject to performance conditions and vest over a three year period. |

CEO

Co-Investment Award | January 2013 | Chief Executive only | A one-off award made under Listing Rule 9.4.2 on the appointment of a new CEO in October 2012.

The CEO invested £500,000 into Halfords shares and received a maximum matching award of 3.5 shares for each invested share. Matching shares may vest subject to achieving share price performance targets over a period between three and five years. |

Executive Directors' Service Agreements

Term

The Company's policy in relation to contractual terms on termination, and any payments made, is that they should be fair to the individual, the Company and shareholders. Failure should not be rewarded and the departing Executive's duty to mitigate loss should be fully recognised. The Committee periodically reviews the Group's policy on the duration of Directors' service agreements, and the notice periods and termination provisions contained in those agreements. The Company is aware that companies are encouraged to consider notice periods of less than 12 months, and in contracting with the new CEO it was agreed that a notice period of six months was appropriate. The notice periods of the other Executive Directors remain limited to 12 months. The Committee will continue to review this policy, to ensure that it is more in line with the Company's overall remuneration policy.

| Date of Service Agreement | Notice Period |

|---|

| Matthew Davies | 4 October 2012 | 6 months |

| Andrew Findlay(1) | 16 November 2010 | 12 months |

| Paul McClenaghan(2) | 9 May 2005 | 12 months |

- Andrew Findlay was appointed to the Board on 1 February 2011 and his service agreement was effective from that date.

- Paul McClenaghan resigned on 12 April 2013.

Early Termination of contract

No compensation would be payable if a service contract were to be terminated by notice from an Executive Director or for lawful early termination by the Company. The Company may terminate any of the above service agreements in accordance with the appropriate notice periods. In the event of early termination (other than for a reason justifying summary termination in accordance with the terms of the service agreement) the Company may (but is not obliged to) pay to the Executive Director, in lieu of notice, a sum equal to the annual value (six months for the CEO) of the Executive Director's then salary, benefits and pension contributions, which he would have received during the contractual notice period, the sum of which shall be payable in 12 monthly instalments (six for the CEO). In respect of any bonus entitlement earned during a financial period prior to termination of employment this will be calculated by the Remuneration Committee, if the Director is deemed by the Committee to be a Good Leaver, on a pro rata basis by reference to their period of service in the financial period in which their employment is terminated. If the Director's employment is terminated in circumstances that the Committee reasonably believes that they cannot be designated a Good Leaver the Director shall forfeit any entitlement to a bonus payment.

Mitigation in Termination

In such instances the Executive Director shall use their best endeavours to secure an alternative source of remuneration, thus mitigating any loss to the Company, and shall provide the Board with evidence of such endeavours upon their reasonable request. If the Director fails to provide such evidence the Board may cease all further payments of compensation. To the extent that the Executive Director receives any sums as a result of alternative employment or provision of services while he is receiving such payments from the Company, the payments shall be reduced by the amount of such sums. In Good Leaver circumstances the Executive Director might be offered a lump sum termination payment paid at the time they cease employment which in all cases will be less than he would receive if he were to be paid his annual salary over 12 months (six months for the CEO).

Change of Control

The service agreements of Executive Directors do not provide for any enhanced payments in the event of a change of control of the Company.

Loss of Office Payments

The Company's policy towards exit payments is that under no circumstances will they exceed the contractual obligations afforded to the Executive Director and contained within their contract of employment. There are a number of ways in which an Executive Director can leave the business and each circumstance is dealt with differently in respect of how exit payments are calculated.

Share plans – leaver treatment

The treatment of outstanding share awards in the event that an Executive Director leaves is governed by the relevant share plan rules. The following table summarises leaver provisions under the executive share plans. In specific circumstances the Committee may exercise its discretion to modify the policy outlined if the rules of the share plan allow such discretion.

| 'Good leavers' as determined

by the Committee | Leavers in other circumstances

(other than gross misconduct) |

|---|

| Halfords Company Share Option Scheme | The Committee may determine that awards should vest at the time of leaving taking into account performance. The exercising of any such vest must take place within 6 months of the leaving date.

6 months from leaving to exercise options. | Awards normally lapse on leaving unless the Committee determines otherwise.

6 months from the date of leaving to exercise vested but unexercised options. |

| Halfords Performance Share Plan | Awards may vest at the end of the performance period, generally taking into account time in employment and performance.

Alternatively the Committee may determine that awards should vest at the time of leaving, generally taking into account time in employment and performance.

12 months from vesting to exercise options if awards structured as nil-cost options. | Awards normally lapse on leaving.

12 months to exercise vested but unexercised options (if applicable) unless the Committee determines otherwise. |

| CEO Co-Investment Award | The Committee may determine that matching shares may vest at the normal vesting date or at the time of leaving based on performance taking into account time in employment.

12 months from vesting to exercise matching shares. | Unvested Matching Shares normally lapse on leaving.

12 months to exercise any Matching Shares that have vested at cessation of employment. |

The leavers treatment under the Halfords Sharesave Scheme is determined in accordance with HMRC provisions.

In the event of gross misconduct all outstanding share awards would generally be forfeited.

Non-Executive Directors' Remuneration Policy

The fees of Non-Executive Directors shall be reviewed every two years to ensure that they are in line with market norms so that the Company can attract and retain individuals of the appropriate calibre and any changes to said fees will be approved by the Board as a whole following a recommendation from the Chief Executive.

Current fees for Non-Executive Directors are as follows:

| Chairman | £165,000 |

| Base fee | £45,000 |

| Additional fees | |

| Senior Independent Directors | £15,000 |

| Committee Chairman (Audit and Remuneration) | £5,000 |

None of the Non-Executive Directors has an employment contract with the Company. However, each has entered into a letter of appointment with the Company confirming their appointment for a period of three years, unless terminated by either party giving the other not less than three months' notice or by the Company on payment of fees in lieu of notice.

The appointment period for each Non-Executive Director is set out below:

| Director | Date of Appointment | Date of Current Appointment | Date of resignation | Expiry Date | Unexpired

term at the

date of this

Report |

|---|

| Dennis Millard | 28 May 2009 | 29 May 2012 | – | 29 May 2015 | 24 months |

| Bill Ronald | 17 May 2004 | 2 August 2011 | – | 26 July 2013 | 2 months |

| David Adams | 1 March 2011 | 2 August 2011 | – | 28 February 2014 | 9 months |

| Claudia Arney | 25 January 2011 | 2 August 2011 | – | 24 January 2014 | 8 months |

| Keith Harris | 17 May 2004 | 2 August 2011 | – | 26 July 2013 | 2 months |

Their appointments are subject to the provisions of the Companies Act 1985 and 2006 and the Company's Articles of Association and in particular the need for re-election. Continuation of an individual Non-Executive Director's appointment is also contingent on that Non-Executive Director's satisfactory performance, which is evaluated annually.

No compensation would be payable to a Non-Executive Director if his or her engagement were terminated as a result of him or her retiring by rotation at an Annual General Meeting, not being elected or re-elected at an Annual General Meeting or otherwise ceasing to hold office under the provisions of the Articles of Association of the Company. There are no provisions for compensation being payable upon early termination of the appointment of a Non-Executive Director.

Outside Appointments

Halfords recognises that its Executive Directors may be invited to become Non-Executive Directors of other companies. Such non-executive duties can broaden experience and knowledge which can benefit Halfords. Subject to approval by the Board, Executive Directors are allowed to accept non-executive appointments and retain the fees received, provided that these appointments are not likely to lead to conflicts of interest. David Wild is a Non-Executive of Premier Foods plc and between 31 March 2012 and 19 July 2012 received fees of £17,161 and Matt Davies is a Non-Executive Director of Dunelm Group plc and between 4 October 2012 and 29 March 2012 received fees of £15,000.

Remuneration Arrangements elsewhere in the Group

The remuneration policy for executive managers in the Group is similar to the policy for Executive Directors as set out in this report — a substantial proportion of remuneration is performance related in order to encourage and reward superior business performance and shareholder returns and remuneration is linked to both individual and Company performance. Basic salary is targeted at normal commercial rates for comparable roles and is benchmarked at appropriate intervals. Bonuses of up to 100% of salary can be earned on the same basis as the Executive Directors. Senior Executives immediately below the Board also benefit from participation in the PSP.

Increases to Executive managers' base salaries are considered at the same time as all other colleagues across the Group and other than benchmarking increases to ensure that the Group is attracting and retaining the right calibre of executive, increases are in line with all colleagues. Increases have been as follows — October 2012: 1.8% (Executive Directors: £Nil), April 2012: 2% (Executive Directors: 2%).

All of the Group's c.12,000 colleagues are eligible to join the Halfords Sharesave Plan (SAYE) after they have served one complete month's service. At the same time they are all eligible for some form of quarterly or full year bonus, although the type, limits and performance conditions vary according to job level. Senior managers and other key management individuals are invited to join the Company Share Option Scheme.

In 2012/13 all newly appointed colleagues and other existing colleagues who had experienced a 'joining-trigger' event were eligible to join the Halfords Pension Plan 2009. All members of the Pension Plan are required to make a minimum contribution of 3% and the Company also contributes a minimum of 3%, dependent on length of service and seniority. The Company has also made plans to auto enrol all other colleagues as appropriate.

Dialogue with Shareholders

The views of our shareholders are very important to the Committee and it is our policy to consult with our largest shareholders in advance of making any material changes to the executive remuneration arrangements. The Committee is currently consulting with major shareholders regarding the proposed changes to the PSP performance conditions.

How the remuneration policy will be implemented for 2013/14

Base salary

Base salaries were last reviewed with effect from 1 October 2012 when no increases were awarded to Executive Directors. Current salaries are as follows:

| CEO | £500,000 |

| Finance Director | £280,500 |

In reviewing Executive Directors' responsibilities the Committee determined that the Group's Finance Director, Andrew Findlay, had assumed Board responsibility for a number of areas of the business, most importantly that of IT. This was considered by the Board to be a vital role in the delivery of the Company's Getting Into Gear 2016 programme and as such the Committee considered it appropriate that Andrew receive an increased salary from 1 October 2013 of £325,000.

Annual bonus

The annual bonus opportunity for 2013/14 will remain unchanged as follows:

| CEO | - Maximum opportunity of 150% of base salary

- two-thirds paid in cash

- one-third paid in Halfords shares deferred for three years

|

| Finance Director | - Maximum opportunity of 100% of base salary

- Paid in cash

|

The annual bonus for 2013/14 will continue to be based 75% on Profit Before Tax ("PBT") performance and 25% based on performance against strategic objectives. PBT targets range from 92% of budget, where payment is zero, to 106% of budget for maximum payment.

The Committee reviews the goals included in the strategic objectives portion of the bonus to ensure that remains appropriate. For 2013/14 the Committee determined that the strategic objectives should be linked to the delivery of the Company's long-term strategic goal is to deliver growth in top line revenues. The Executive Team have considered the Getting Into Gear 2016 programme discussed in the Group Chief Executive Officer's Review and Transforming Halfords and have identified measures that will determine the successful delivery of each initiative and these also represent the strategic non-financial KPIs that will form part of the Executive Team's 2013/14 annual bonus plan.

| Strategy | Execution Priority | Measure |

|---|

| Top Line Revenue Growth | Service Revolution | Net promoter score – an industry-wide measure of customer service.

Colleague engagement – a core measure of levels of commitment and advocacy amongst Halfords employees. |

| The H Factor | Value added sales – a combination of our fitting, accessory and attachment sales growth. |

| Stores Fit to Shop | Delivering an effective economic model for retail stores through the 50:39 project. |

| 21st Century Infrastructure | Value added Sales. |

| Click with the Digital Future | Value added Sales. |

In determining whether any bonuses are payable the Committee retains the discretionary authority to increase or decrease the bonus to ensure that the level of bonus paid is appropriate in the context of performance.

Performance Share Plan

The market environment continues to be challenging for retailers. Our strategic focus is on putting in place the foundations to deliver a sustainable business in the future, focusing on an authoritative range of products, colleague and service excellence, digital participation and helpful store environments with the ultimate goal of delivering profitable top line revenue growth and therefore creating shareholder value. As a consequence during the year the Committee reviewed the performance measures used for the PSP and determined that Total Shareholder Return and Earnings Per Share were no longer the most suitable mechanisms for measuring and incentivising the successful delivery of this strategy.

Core awards made under the PSP will continue to be 150% of base salary with the opportunity to earn up to 1.5x this level if exceptional performance is achieved.

The Committee is currently consulting with shareholders regarding these proposed changes and details will be provided in a Stock Exchange announcement when finalised and in next year's report.

How the remuneration policy was implemented in 2012/13

Single remuneration figure for 2012/13

| Base Salary | Bonus

(due in respect of FY13)(2) | Benefits | Pension | PSP (due in respect of performance period ended FY13)(1) | Single Figure 2013 | Single Figure 2012 |

|---|

David Wild

(resigned 19 July 2012) | 150,981 | — | 24,256 | 22,647 | — | 197,884 | 617,000 |

Matt Davies

(appointed 4 October 2012) | 246,795 | 187,500 | 14,318 | 50,000 | — | 498,613 | — |

| Andrew Findlay | 280,500 | 56,100 | 16,335 | 41,250 | — | 394,185 | 339,000 |

Paul McClenaghan

(left on 12 April 2013) | 290,700 | 58,140 | 17,338 | 57,413 | — | 423,591 | 350,000 |

| Totals | 968,976 | 301,740 | 72,247 | 171,310 | — | 1,514,273 | 1,306,000 |

- Shares were awarded in August 2010 in respect of the Halfords Share Performance Plan for the performance period April 2010 to March 2013. In May 2013 the performance conditions for these shares were measured. The Remuneration Committee deemed that none of these conditions had been reached and that all shares award under the 2010 scheme would lapse. The measurement of the performance conditions for the 2010–2013 scheme is given here.

- Calculation of the Bonus payable in respect of the period ended 29 March 2013 is shown here.

Calculation of FY12 Single figure comparative

| Base Salary | Bonus

(due in respect

of FY12) | Benefits | Pension | PSP (due in respect of performance period ended FY12)(3) | Single Figure

2012(4) |

|---|

| David Wild | 513,000 | — | 27,000 | 77,000 | — | 617,000 |

Matt Davies

(appointed 4 October 2012) | — | — | — | — | — | — |

| Andrew Findlay | 278,000 | — | 13,000 | 48,000 | — | 339,000 |

| Paul McClenaghan | 277,000 | — | 16,000 | 57,000 | — | 350,000 |

| Totals | 1,068,000 | — | 56,000 | 182,000 | — | 1,306,000 |

- Shares were awarded in August 2009 in respect of the Halfords Share Performance Plan for the performance period April 2009 to March 2012. In August 2012 the performance conditions for these shares was measured. The Remuneration Committee deemed that none of these conditions had been reached and that all shares award under the 2009 scheme would lapse.

- All 2012 figures have been rounded to the nearest thousand as per the Annual Report & Accounts 2012.

Salary and Benefits

The last Group-wide salary review was undertaken in October 2011 which took into account remuneration trends, candidate quality and job location in markets in which the Group had recently recruited. With respect to the Executives, the salary review also considered executive remuneration market trends and benchmarking. Salary increases not exceeding 2% were made to all Group colleagues, including some Executive Directors in April 2012 following no increases in the previous 12 months. In October 2012 the Group reverted to the normal review timing and further increases of 1.8% were made to Group colleagues; however, Executive Directors were excluded from this round of increases.

Annual Bonus for 2012/13

Annual Bonus for 2012/13 for the Finance Director and Commercial Directors was based 75% on Group PBT and 25% on key strategic projects. These key projects included delivering an increase in the Company's Fitting proposition; increasing the range of parts, accessories and clothing on offer in the Company's Cycling category; the development of new store formats; driving the Autocentres business; and improving both Colleague and Customer engagement with the Halfords brand.

Annual Bonuses reported in the above table and payable in May 2013 for the financial period ended 29 March 2013 were calculated as follows.

| | Performance | |

|---|

| Measure | Bonus Opportunity

(% of salary) | Below

Threshold | Threshold | Target | Stretch | Bonus

awarded

(% of salary) |

|---|

| PBT | 75% | 0% | 92% | 100% | 106% | PBT for the year of £72.0m during the year was below the level required for threshold levels of performance and therefore 0% is payable in relation to this proportion. |

| Strategic Projects | 25% | 0% | n/a | 25% | n/a | 20% |

| The Remuneration Committee have discretion to judge whether they believe that each of these projects has been attained and to the extent that they believe they have been achieved. In deliberating on each KPI the Committee concluded that the following percentage achievements had been realised: |

| — Fitting proposition; | Increase in Revenues from Fitting by 36%. | 100% | — | 20% |

| — Cycling parts, accessories and clothing; | 15,000 SKU's ready for launch in June 2013. | 50% | — |

| — Development of new store formats; | Development of laboratory stores. Review and learnings for FY14 50:39 Project. | 50% | — |

| — Driving the Autocentres business; | Integration of Halfords Autocentres into Group Support Centre and opening of 23 new centres. | 100% | — |

| — and improving both Colleague and Customer engagement with the Halfords brand. | Colleague Engagement score increased from 64% in 2012 to 77% in April 2013. | 100% | — |

On appointment, the Committee agreed that the CEO should participate in an annual bonus for his period from appointment on 4 October 2012 to the end of the financial year, 29 March 2013. His maximum bonus opportunity for this period was set at 50% of this normal maximum (i.e. 75% of his full year base salary), with two-thirds paid in cash and one-third deferred into shares for a period of three years. Fifty per cent of the bonus was based on PBT performance and 50% was based on the delivery of key personal performance objectives which were considered by the Committee to be key objectives for the initial period of his tenure. These included reviewing and formulating a new strategy, undertaking a review of the executive committee organisational capability and improving employee engagement.

The Committee reviewed the achievement of the new CEO's bonus targets and concluded that he had met all of the personal performance objectives set on his appointment in October 2012. The key objectives included: a review of the business and the formulation of a new strategy; a review of the organisational capability of the business; the creation of a new executive management team; and, a positive movement in the Colleague Engagement score (which increased from 64% to 77%). Although the Group achieved profits in line with the guidance that was indicated to the market after the new CEO's appointment, it was considered by the Committee that, given the profit performance of the Group relative to original budget and initial market guidance, no award for the profit element of his bonus be made. Thus 50% of the available pro rata bonus was payable, of which one-third would be deferred into shares.

The Committee reviewed the annual bonus payout in the context of the performance of the underlying business during the year and the delivery against strategy and determined that the level of bonus paid was appropriate in this context.

Benefits

Benefits include payments made in relation to private health insurance and the provision of a company car or equivalent cash allowance.

Pension

Pension payments represent contributions made either to defined contribution pension schemes or personal funds, the purpose of which is to provide additional benefits, made by the Group during the period to 29 March 2013 in respect of qualifying services of the Executive Directors. Paul McClenaghan sacrificed some of his salary for like-for-like contributions to the Halfords Pension Plan.

Performance share plan

2010 awards based on performance between 27 March 2010 and 29 March 2013

Awards granted in 2010 were subject to the following performance conditions:

| | TSR Performance

Element (50% of

award) | EPS Performance

Element (50% of

award) |

|---|

| Award "Multiplier" (up to 1.5 x initial award) i.e. 225% of salary. | 1.5 x initial award vesting | Upper Decile

performance | 16% growth p.a.

above RPI |

| Straight-line vesting | Between Upper Quartile

and Upper Decile

performance | Between 11% growth

p.a. and 16% growth

p.a. above RPI |

Core Award

(150% of salary) | 100% Vesting | Upper Quartile

performance | 11% growth p.a. above

RPI |

| Straight-line vesting | Between Median

and Upper Quartile

performance | Between 4% growth p.a.

and 11% growth p.a.

above RPI |

| 30% Vesting | Median performance | 4% growth p.a.

above RPI |

| 0% Vesting | Below Median

performance | Below 4% growth p.a.

above RPI |

TSR and EPS performance is assessed on an independent basis. However, to ensure that the PSP continued to support sustainable performance, the multiplier for one measure is only applied if performance is at least at the threshold level for the other measure. The companies included in the TSR comparator group for awards granted in 2010 are as follows:

Brown Group; Carpetright; Carphone Warehouse; Debenhams; Dignity; Dixons Retail plc (formerly DSG International); Dunelm Group; Game Group (de-listed on 3 April 2012); Greggs; Home Retail Group; JD Sports Fashion plc; Darty (formerly Kesa Electricals); Kingfisher International; Marks & Spencer Group; Morrison (WM); Mothercare; Next; Sainsbury (J); Sports Direct; Tesco; WH Smith.

Based on TSR performance between 27 March 2010 and 29 March 2013, Halfords was ranked 16th against the comparator group and therefore no portion of the TSR element of the award will vest. EPS growth between FY10 and FY13 was below that of RPI over the same period and therefore no portion of the EPS element of the award will vest. The 2010 PSP award will therefore lapse in full in August 2013.

Outstanding PSP awards

PSP awards granted in 2011 and 2012 are subject to the same performance conditions as those outlined above for the 2010 PSP award. The companies included in the TSR comparator group are based on the FTSE 350 general retail and food retail companies on the date of grant.

CEO Co-Investment Award

On appointment the Company made the CEO a Co-Investment Award, the details of which are set out in the Stock Exchange announcement issued on his appointment. This Award is designed to recruit and retain an executive of calibre required to run the business and to incentivise the CEO to deliver exceptional shareholder value creation through the achievement of share price performance targets.

This plan was adopted for the sole purpose of making a one-off award to the Group's new CEO and was adopted under Listing Rule 9.4.2 where the long-term incentive scheme arrangements are for an "individual whose appointment as a director is being contemplated and the arrangement is established specifically to facilitate, in unusual circumstances, the recruitment and retention of the relevant individual". It is currently intended that no further awards either to the Group's CEO or other executives will be made under this plan.

Under the Plan the CEO invested £500,000 into Halfords shares, acquiring 164,056 shares at 302.22p per share. The CEO was then awarded a maximum matching award of 3.5✕ the number of invested shares (574,196 shares). Subject to continued employment these shares may vest up to a third in November 2015, up to two-thirds in November 2016 and in full in November 2017, depending on the following Threshold (30% vesting) and Maximum (100% vesting) share price performance targets of Halfords:

| November | Threshold | Maximum |

|---|

| 2015 | 350p | 400p |

| 2016 | 385p | 440p |

| 2017 | 425p | 485p |

Share Price performance will be assessed using the average mid-market closing share price for the 30 days following the announcement of the Interim results for the relevant year (normally November). At each relevant vesting date the CEO may decide to either exercise any portion of the award that has vested based on performance at that time (in which case any unvested shares in that tranche in respect of which the share price target has not been met will lapse) or roll forward that tranche in full to be subject to performance testing at the next vesting date. In the latter case ("roll-forward") the Participant will forfeit the right to exercise any awards that had become capable of vesting at the earlier vesting date.

Matching shares were granted in the form of nil cost options. Vested options can be exercised until the 10th anniversary of the date of grant. Matching shares may accrue additional shares related to dividends.

Prior to vesting the Committee will satisfy themselves that the achievement of the Share Price Target is a genuine reflection of the Company's underlying financial performance and may adjust the level of vesting accordingly. The Committee may determine that Matching Shares can be scaled back before exercise for circumstances such as material misstatement, the individual being responsible for serious reputational damage to the Company, or in circumstances where the Company suffers serious losses.

The Committee believes that the design of the plan is appropriate and necessary to recruit an individual of the CEO's calibre and that the structure will incentivise him to drive exceptional business performance.

Shareholding guidelines

The Committee believes that it is important that Executive Directors are also long-term shareholders in the business because as such Executives are incentivised to deliver the corporate strategy, thus creating value for all shareholders.

| Matt Davies | Andrew Findlay | Paul McClenaghan |

|---|

| Shareholding Guidelines (% of base salary) | 100% | 100% | 100% |

| Current Shareholding | 164,056 | 4,900 | 100,000 |

| Current Value (based on share price on 29 March 2013) | £510,706 | £15,254 | £311,300 |

| Current % of Salary | 102% | 5% | 107.1% |

| Date by which guideline should be complied with | 4 October 2017 | 1 February 2016 | —

Paul left on

12 April 2013 |

These figures include those of their spouse or civil partner and infant children, or stepchildren, as required by Section 822 of the Companies Act 2006. There was no change in theses beneficial interests between the 29 March 2013 and 23 May 2013.

Loss of Office Payments

David Wild resigned from the business on 19 July 2012 and was paid his contractual obligations, the details of which were set out in the Stock Exchange announcement issued at the date of his resignation. Mr Wild shall receive a total of payment of £645,399 comprising salary and benefits for his notice period. This is being made in 12 equal instalments and Mr Wild has a duty to mitigate by making reasonable efforts to obtain suitable alternative employment. Paul McClenaghan who left the business on 12 April 2013 was treated as a Good Leaver and allowed to retain his PSP awards which will vest on a pro rata basis in relation to the time of the performance period and his leaving date. He was also paid a lump sum of £218,025 being equivalent to nine months' salary in full and final settlement of any contractual obligations.

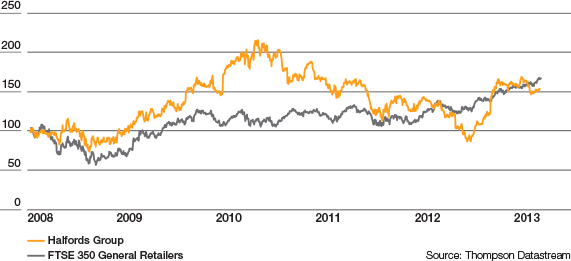

TSR performance graph

The following graph shows the TSR performance of the Company since April 2008, against the FTSE 350 General Retailers (which was chosen because it represents a broad equity market index of which the Company is a constituent).

TSR was calculated by reference to the growth in share price, as adjusted for reinvested dividends.

TSR Graph

Importance of Pay

The Committee is aware of the importance of pay across the Group in delivering the Group's strategy and of shareholder views on executive remuneration and the relation of these payments to other cash disbursements. The following table shows the relationship between the Company's financial performance, payments made to shareholders, payments made to tax authorities and expenditure on payroll.

| 2013 | 2012 |

|---|

| EBITDA | £103.4m | £123.6m |

| PBT (underlying) | £72.0m | £92.2m |

| Payments to Shareholders; | | |

| Dividend | £42.7m | £44.2m |

| Share Buyback | £0.9m | £62.3m |

| Payments to Tax Authorities(1); | | |

| Corporation Tax | £18.2m | £24.6m |

| Payroll Taxes | £25.2m | £33.2m |

| Other Taxes(2) | £102.8m(3) | £55.4m |

| Payments to Employees; | | |

| Wages & Salaries | £153.5m | £150.8m |

| Including Directors(4) | £1.51m | £1.31m |

- Includes payments made to both UK & Irish tax authorities

- Includes net VAT collected

- Includes Business Rates of £34.7m

- Based on the single figure calculation, not all of which is included within wages and salary costs.

Members of the Committee

During the year and the period to the date of this report the Remuneration Committee (the "Committee") consisted of Keith Harris, Chairman; Dennis Millard; Bill Ronald; David Adams; and Claudia Arney.

Annual Activity

During the year and the period to the date of this report the Committee has;

| Standing Items | One-Off Considerations |

|---|

May 2012 | |

| Approved Directors Remuneration Report for 2012. | Considered the introduction of non-financial KPIs as metrics for the Annual Bonus. |

| Discussed Annual Bonus parameters for FY13. | |

| Considered the appropriateness of the performance conditions of the Company's Performance Share Plan. The Committee considered the performance measures that applied to the 2012–15 scheme and concluded that these continue to be appropriate for the business. | |

| Assessed TSR and EPS performance for the 2009–2012 Performance Share Plan. These targets were not met and therefore this award will not vest. | |

| Assessed EPS performance for the 2009–2012 Company Share Option Scheme. These targets were not met and therefore this award will not vest. | |

July 2012 | |

| Granted awards under the Company's Performance Share Plan and Company Share Option Scheme. | Considered the quantum of any termination payments to be made on the exit from the business of David Wild. |

| Approved the chosen non-financial KPIs for inclusion in the FY13 Annual Bonus Plan. |

September 2012 | |

| Considered the remuneration package for a new CEO, Matthew Davies. |

January 2013 | |

| Considered and approved the terms of the CEO Co-Investment award. |

March 2013 | |

| Considered the Group's remuneration policy to ensure the broad policy continued to be aligned with the strategy and long-term success of the business. | Considered changes to the performance conditions of the Halfords Performance Share Plan. |

| Considered whether the remuneration arrangements, including variable, performance-based elements, continue to be structured to ensure associated performance remains aligned with the strategic objectives of the Company and incentivises managers. | |

| Consideration was given to the performance conditions and targets for the Executive Directors' and senior managers' short-term bonus arrangements for 2013/14. | |

May 2013 | |

| Approved Directors' Remuneration Report for 2013. | Considered the use of new performance conditions for the Halfords Performance Share Plan in order to give Executive Directors convergence with the share price targets associated with the Co-Investment Plan. |

| Assessed TSR and EPS performance for the 2010–2013 Performance Share Plan. These targets were not met and therefore this award will not vest. | Requested that the Chairman of the Committee consulted with the Company's major shareholders to discuss possible changes to the performance conditions of the Company's Performance Share Plan. |

| Assessed EPS performance for the 2010–2013 Company Share Option Scheme. These targets were not met and therefore this award will not vest. | |

| Considered the achievement of the 2012/13 bonus performance conditions. | |

| Approved the Committee's Terms of Reference. | |

Advisors

During the year the Committee has been supported by Jonathan Crookall, People Director, and Alex Henderson, Company Secretary. The CEO and CFO may also on occasion attend Committee meetings on the request of the Committee but are not present when their own remuneration is discussed. The Committee also engaged with Deloitte LLP, who have advised on the implementation, rules and performance conditions of the Halfords Group plc 2012 Co-Investment Plan, performance measures for the PSP, remuneration reporting and other remuneration matters. Deloitte are founding members of the Remuneration Consultants Group and adhere to the Remuneration Consultants Group Code of Conduct when dealing with the Committee. The Committee considers their advice to be independent and impartial. Fees paid to Deloitte for this advice were £68,100.

Shareholder voting

Halfords remains committed to ongoing shareholder dialogue and carefully reviews voting outcomes on remuneration matters. In the event of a substantial vote against a resolution in relation to Directors' remuneration, Halfords would seek to understand the reasons for any such vote, and would detail any actions in response to it in the Directors' Remuneration Report.

The following table sets out actual voting in respect of our last report in 2012:

| % of votes | For | Against |

|---|

| For 2011/12 Directors' Remuneration Report (2012 AGM) | 98.7% | 1.3% |

5,636,814 votes were withheld in relation to this resolution (c.3% of shareholders).

Audited information

Directors' Emoluments as disclosed in the Company's financial statements:

| Base Salary | Bonus | Benefits | Pensions | 2013 | 2012 |

|---|

David Wild

(resigned 19 July 2012) | 517,650(1) | — | 24,256 | 22,647 | 530,000 | 540,000 |

Matt Davies

(appointed 4 October 2012) | 246,795 | — | 14,318 | 50,000 | 311,113 | — |

| Andrew Findlay | 280,500 | — | 16,335 | 41,250 | 349,600 | 291,500 |

Paul McClenaghan

(Left on12 April 2013) | 290,700 | — | 17,338 | 57,413 | 364,840 | 293,500 |

- Includes £366,669 as compensation for loss of office.

Halfords Group plc 2005 Performance Share Plan

| Award

Date | Mid-market

price on date

of awards | Awards held

30 March

2012 | Awarded

during the

period | Dividend

Reinvest-

ment(1) | Forfeited

during the

period | Lapsed

during the

period | Exercised

during the

year | Awards held

29 March

2013 | Performance

period

3 years to |

|---|

| David Wild | 3 August

2009 | 3.46 | 330,440 | — | 21,671 | 352,111 | — | — | — | 30 March

2012 |

| 3 August

2010 | 4.86 | 171,444 | — | 11,244 | 182,688 | | — | — | 29 March

2013 |

| 8 August

2011 | 3.00 | 260,467 | — | 17,082 | 277,549 | — | — | — | 28 March

2014 |

| Paul McClenaghan | 3 August

2009 | 3.46 | 126,393 | — | 8289 | | 134,682(2) | — | — | 30 March

2012 |

| 3 August

2010 | 4.86 | 96,280 | — | 8,633 | | | | 104,913 | 29 March

2013 |

| 8 August

2011 | 3.00 | 146,272 | — | 13,155 | — | — | — | 159,427 | 28 March

2014 |

| 3 August

2012 | 2.20 | — | 198,502 | 4,486 | — | — | — | 202,988 | 3 April

2015 |

| Andrew Findlay | 8 August

2011 | 3.00 | 211,709 | — | 18,983 | — | — | — | 230,692 | 28 March

2014 |

| 3 August

2012 | 2.20 | — | 191,537 | 4,329 | — | — | — | 195,866 | 3 April

2015 |

- Following the recommendation of the Remuneration Committee to reinvest dividends earned on shares awarded since 2009, interim and final dividends have been reinvested in shares at prices between £2.1347 and £4.8110.

- In August 2012 the Remuneration Committee measured the performance conditions of 2009 Performance Share Plan award and deemed that none of the performance conditions had reached median levels and therefore the whole award should lapse.

Halfords Group plc 2012 Co-Investment Plan

| Award

Date | Awards held

30 March

2012 | Awarded

during the

period | Dividend

Reinvest-

ment(1) | Lapsed

during the period | Exercised

during the

year | Awards held

29 March

2013 | Performance

period

3–5 years |

|---|

| Matt Davies | 28 January

2013 | — | 574,196(1) | | — | — | 574,196 | November

2015

November

2016

November

2017 |

- This award represents 3.5 times Matthew Davies' initial investment of 164,056 shares purchased at a price of 302.22p on 4 October 2012.

Non-Executive Directors

Fees

| Director | Role | Senior

Independent

Director | Committee

Chairman

Fees | Executive

Chairman

Fees(1) | Fees | 2013 | 2012 |

|---|

| Dennis Millard | Chairman | — | — | 50,000 | 165,000 | 215,000 | 165,000 |

| Bill Ronald | Senior Independent Director | 15,000 | — | | 45,000 | 60,000 | 60,000 |

| David Adams | Audit Committee Chairman | — | 5,000 | | 45,000 | 50,000 | 50,000 |

| Claudia Arney | NED | — | — | | 45,000 | 45,000 | 45,000 |

| Keith Harris | Remuneration Committee Chairman | — | 5,000 | | 45,000 | 50,000 | 50,000 |

- Following the resignation of David Wild on 19 July 2012, the Board asked Dennis Millard, non-executive Chairman, to become interim Executive Chairman with immediate effect. The Remuneration Committee approved the payment of £50,000 to Dennis for his services as Executive Chairman. Such flat fee would cover the length of any period that Dennis might serve in this position. He continued in this position until 21 November 2012. Matt Davies was appointed CEO of the Company on 4 October 2012.

Non-Executive Director Shareholding

| Director | 2013 | 2012 |

|---|

| Dennis Millard | 40,000 | 32,500 |

| Bill Ronald | 11,538 | 11,538 |

| David Adams | 6,000 | — |

| Claudia Arney | 21,052 | — |

| Keith Harris | 3,386 | 3,846 |

These figures include those of their spouses, civil partners and infant children, or stepchildren, as required by Section 822 of the Companies Act 2006. There was no change in these beneficial interests between 29 March 2013 and 23 May 2013.

Keith Harris

Chairman of the Remuneration Committee

23 May 2013